U.S. Oil Prices Plunge into the Negatives

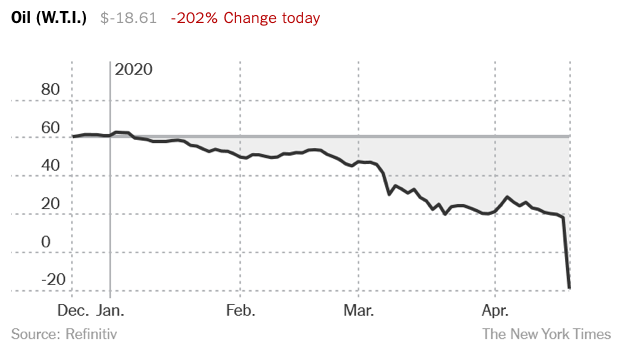

For the first time in American history, oil has become worthless. The West Texas intermediate (WTI), used as a benchmark in oil pricing has closed in the negative margin marking a historic moment in the oil market.

According to the New York Times, as of 4 p.m. on Monday, one barrel of crude oil costs -$18.61, suggesting that people that have oil would be paying others to take barrels out of their hands.

How did this happen? Due to the corona virus pandemic, more oil is being produced and not much is being used. Because of this, storage tanks are running out of space to store the unused barrels. Many people feared that the storage tanks were close to reaching full capacity on oil, and that fear turned into the negative numbers on the market.

However, there is hope for the oil market. According to Pippa Stevens, a markets reporter for CNBC, long term contracts for oil see it being traded at above $20 a barrel.

Live updates on oil prices and the stock market can be found on the New York Times, linked below.

https://www.nytimes.com/2020/04/20/business/stock-market-live-trading-coronavirus.html

Denida Rahmani is currently a senior at Faith Lutheran High School. She first took a journalism class as a seventh grader and has been in the Film and...